Students are increasingly turning to student loans to cover the rising cost of higher education. Yet, it can result in excessive student loan debt that is difficult to repay. Politicians have responded by proposing programs to cancel student loan debt in an effort to boost their countries’ educational systems.

The Student Debt Relief Plan of the Biden-Harris Administration was just launched by former US Vice President Kamala Harris and former US Vice President Joe Biden. Here is all the information you’ll need to apply for this program when it opens its virtual doors.

What Is A Student Loan Debt Relief Application?

The Federal Reserve estimates that by the end of 2020, Americans will have accrued $1.71 trillion in student loan debt. As of December 2010, the total was $845 billion, an increase of 102% over the previous decade. That means that seventeen percent of the American population is reliant on student loans to finish their education. Only 6% of the population actually makes monthly payments on their student loans; the remainder has outstanding balances.

As a result of the burden of student loan repayment, many students drop out of school before completing their studies. As a result, the US government established the Student Debt Relief Plan to counteract this deterrent and keep students enrolled in school.

Those who qualify can get up to $20,000 to put toward their loan debt, and this program cancels that obligation. According to the White House, 40 million students will benefit from the reduced interest rates on their loan balances. Twenty million students’ outstanding balances will be erased as a result.

Students should get ready to register for the upcoming online registration for student loan debt reduction. In January, you’ll have to start making payments.

Must Check

- How To Use Venmo With Uber And Uber Eats?

- What Is Gcash And How To Delete Transaction History In GCash?

Eligibility:

Earlier this month, White House press secretary Karine Jean-Pierre announced that Student Loan Forgiveness applications would be available online in October. Here are the requirements that must be met for you to be considered for this relief:

- The individual’s household income should be between $120,000 and $250,000.

- Any income below that threshold is also acceptable. They might qualify for a Pell Grant, which provides financial aid of up to $20,000.

- Employees of the federal, state, tribal, military, local, and non-profit sectors in the United States are also entitled to petition for debt cancellation. Workers in the public sector need to have a minimum of 10 years of experience in the field.

- The administration has stated that those who apply to the program before October 31 have a better chance of being accepted. It’s a limited-time offer that gives you some leeway in how you deal with your debt.

Get in on this limited-time offer by signing up now to improve your odds of being chosen.

Requirements:

Applicants can move forward with the application process once they have satisfied all eligibility requirements. But first, let’s take a look at everything that has to be done to apply for student loan debt relief:

- A parent PLUS loan can be shown by applicants. If the parents of the student meet the income requirements and have a PLUS loan, they might be eligible for the debt relief program. It’s not required, but it makes the chance of being chosen better.

- If the Federal Student has a master’s or bachelor’s degree, they must show it.

- It shouldn’t be more than $125,000 or $250,000. No need to send in proof of income documents because the federal government will check based on your income tax return.

Bring all of these things with you when you apply, and make sure you meet the eligibility requirements. The program to help pay off student loans will be done online, with as few forms as possible. Also, it is quick and easy to use.

Remember that if you have a private student loan, you can’t fill out an application for help with your student loan debt.

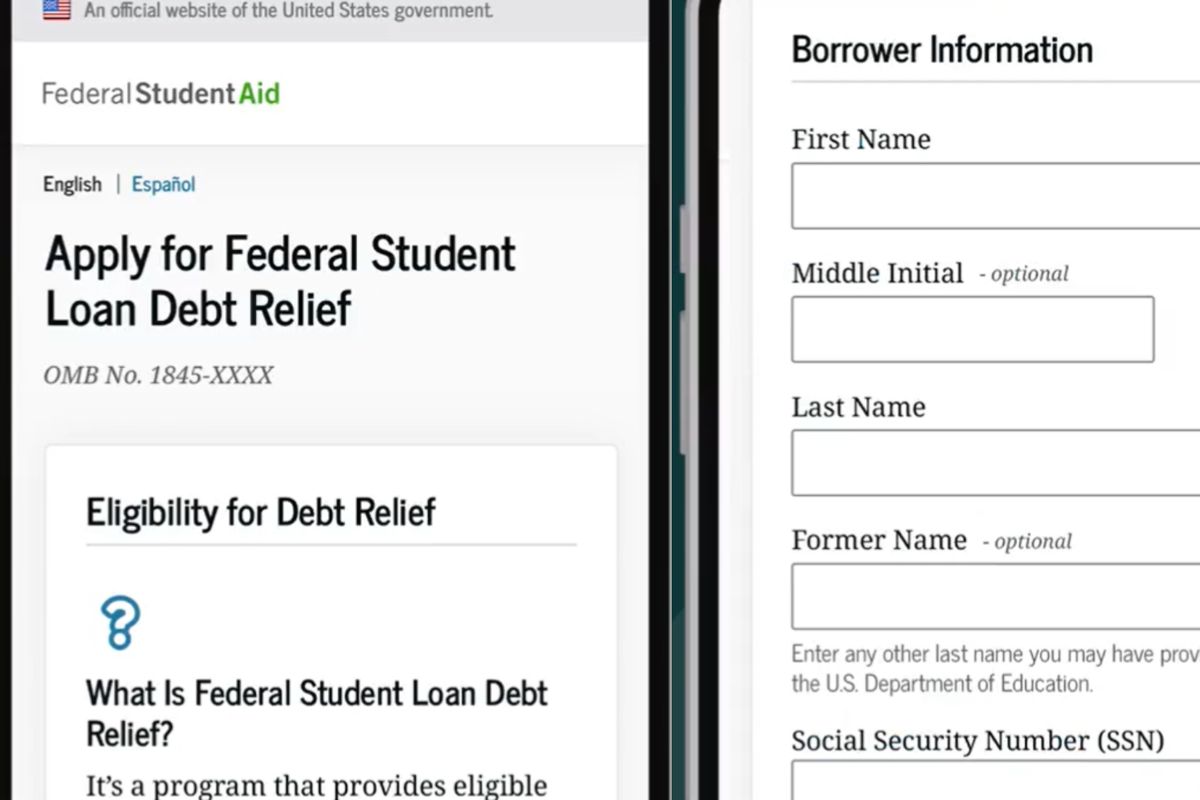

How To Apply For Biden’s One-time Student Loan Debt Relief Application?

Here’s how to apply for a one-time student loan debt relief application, step by step:

- Students who are interested must sign up for an account at StudentAid.gov and give a valid email address and password.

- You will get all the latest information about the application sent to your email. So, keep an eye out and check your email often.

- Borrowers do not have to include their FSA ID or any other paperwork with their applications.

- Fill in your information in the application state.

- If you fill out an application online, you will get a paper copy of it.

Federal-held applicants can’t send in paperwork because the federal government already knows everything about their loans. Also, the department will check the income information submitted by the borrowers and their parents in 2020 or 2021. Because of this, about 8 million borrowers will be able to get help with their loans as soon as they apply.

Related Articles

- How To Make Payment For Domino’s Pizza With Venmo App?

- How To Add Money To Venmo Card At Walmart (2022)?

How to check the status?

On the “StudentAid.gov” website, you can find information about all the student loan debt relief programs and how to sign up for them. It also has the database of the US Department of Education and information about FSA.

Students can look at their loan payments, balances, and interest rates. The site also has information about the loan servicer and the current status of the loan. So, you can keep track of whether your loan is being paid back or not. Applicants need to go to the Student Aid Website, log in with their correct account information, and check the status of their application.

Status of debt relief for students who want to get a Pell Grant:

- The information about your income will be checked against the tax returns you filled out in 2020 and 2021. That means they should be less than $125,000.

- To get into their FAFSA account, students who want a Pell Grant must sign in. Type in your correct FSA ID.

- Lastly, the Pell Grant is where you can see all the financial aid you have been given. It also lets you look at your Student Aid Report.

The loan forgiveness is given to those who qualify through Federal Student Aid, or FAFSA. Conclusion:

During the announcement of the Student Loan Debt Relief program, US President Biden said, “Education is a ticket to a better life, but over time, that ticket has become too expensive.”

Students who already have a lot of debt will be helped by the program. They will also be encouraged to get more education and degrees without having to worry about paying back loans. In some ways, the government also helps middle-class and low-income people with their money problems.

Keep checking our site NogMagazine.com regularly for the latest updates.

FAQs:

How can I get my student loan wholly forgiven?

The borrowers’ loans can now be forgiven via the Student Debt Relief Plan. Those who want to be considered for the program and have their debts erased must fill out an application.

How do I know if I can get my loans wiped out?

If your household income is less than $125,000, you can get your loans forgiven. If you are chosen, you will get at least $10,000 in relief.

Which loans can be forgiven by the government?

Student loan forgiveness is available for federal loans like subsidized or unsubsidized loans, Parent PLUS loans, and graduate loans.

What kinds of student loans can’t be forgiven?

If borrowers don’t turn their FFEL and Perkin loans into direct loans, they can’t get their loans forgiven.